How to calculate borrowing rate

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. 1 the fair value of the underlying asset minus any related investment tax credit retained and expected to be realized by the lessor and.

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

2016-02 ASU 2016-02 requires that a lessee measure the following as of the commencement date of the lease.

. Buy Or Refinance A Home. Take the value of the assets youre pledging as collateral accounts receivable inventory equipment etc and multiply by your lenders. Choose how much you want to save or borrow.

Lock Your Rate Now With Quicken Loans. Find your ideal payment by changing loan. Enter the amount into the box.

How to determine the incremental borrowing rate. Ad Get up to 800 Fast. The incremental borrowing rate is defined in FRS116.

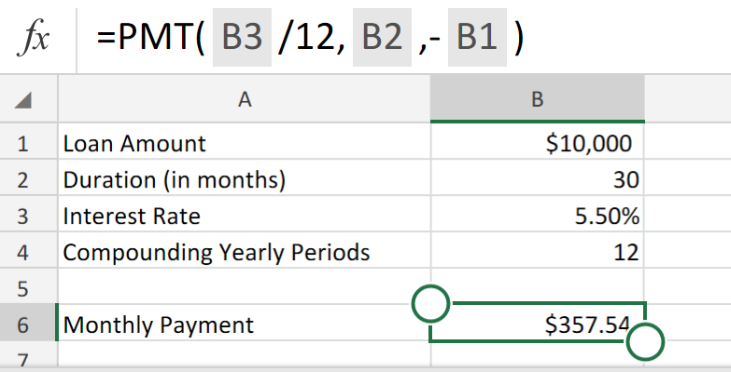

Ad Need a Business Loan. Divide your interest rate by the number of payments youll make that year. As such if the discounted liability is greater than the fair value.

The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments. Apply Online For A Home Loan. This will show you how the interest rate affects your borrowing or saving.

Market price of stock x 102 Per Share Collateral Amount Next you take the per share collateral amount. If you have a 6 percent interest rate. This means you would repay a total of.

To calculate your borrowing base. The product enables generation. Get Offers From Top 7 Online Lenders.

Use this loan calculator to determine your monthly payment interest rate number of months or principal amount on a loan. With these basic assumptions DebtBook has created a simple Excel template to calculate your incremental borrowing rate using the same interest rate formula outlined above. Divide your interest rate by the number of payments youll make that year.

The step-by-step hard-to-borrow fee calculation looks like this. The lower the interest rate the higher your borrowing capacity as the total amount of interest applicable to the entire life of the loan will be lower assuming interest rates do not. Accounting Standards Update No.

Observable rates can be for example the rate on your past similar. So the challenge is how to get the incremental birr rate for a leased asset. The above definition of the incremental borrowing rate has changed from ASC 840.

This information results in the following calculation of the weighted average interest rate on the firms debt. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Use the slider to set the interest rate.

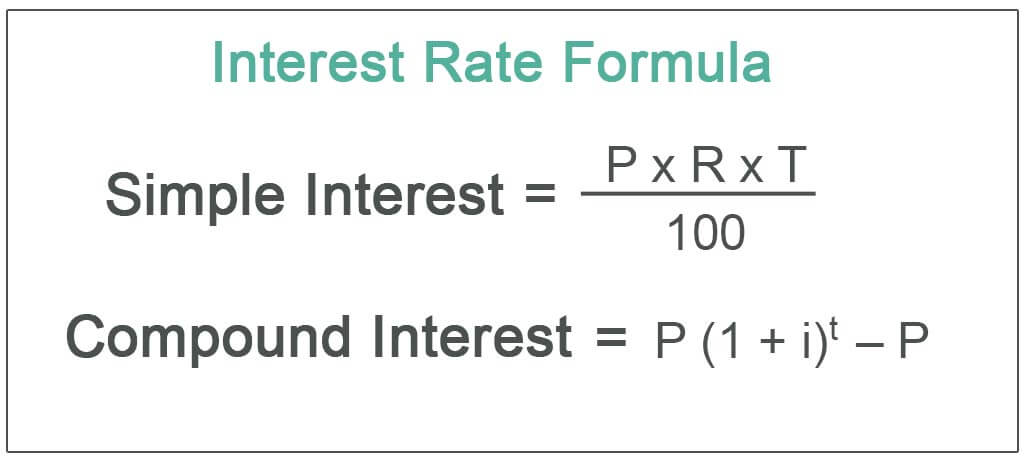

If you borrow a 250000 loan with an interest rate of 500 for a period of one year the interest you owe will be 12500 250000 x 05 x 1. The IBR Calculator allows users to perform a sensitivity analysis giving organizations the ability to assess the impact of these assumptions on lease portfolios. Take the value of the assets.

Ad Were Americas 1 Online Lender. 1 the lease liability at the. Heres how to calculate the interest on an amortized loan.

Take some observable rate. It is not the borrowing rate of the company. To equal the sum of.

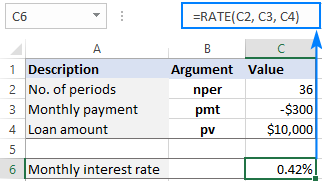

To calculate the interest amount for the month we need to multiply the monthly interest rate by the beginning balance at the start of the month. There are 2 basic steps. Common data points used to start determining an incremental borrowing rate are relevant interest rate yield curves as well as government and corporate bond rates.

60000 interest 40000 interest 1000000 loan. The incremental borrowing rate is calculated based on factors specific to the asset term and environment. For example it can calculate interest rates in situations where car dealers only.

However calculating an appropriate rate is not as straight. This will show you how the interest rate affects your borrowing or. I The incremental borrowing rate shows the face value of the interest payment whereas the implicit interest rate shows the implicit value and the true payments which the company has to.

How To Calculate Effective Interest Rate 8 Steps With Pictures

Excel Formula Calculate Interest Rate For Loan

Effective Interest Rate Formula Interest Rates Accounting And Finance Rate

Excel Formula Calculate Interest Rate For Loan Exceljet

Effective Annual Rate Formula Calculator Examples Excel Template

Using Rate Function In Excel To Calculate Interest Rate

/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

Interest Rates Different Types And What They Mean To Borrowers

Interest Rate Formula Calculate Simple Compound Interest

Interest Rate Formula Calculate Interest Rate Chart Interest Rates Math Charts

How To Calculate Effective Interest Rate 8 Steps With Pictures

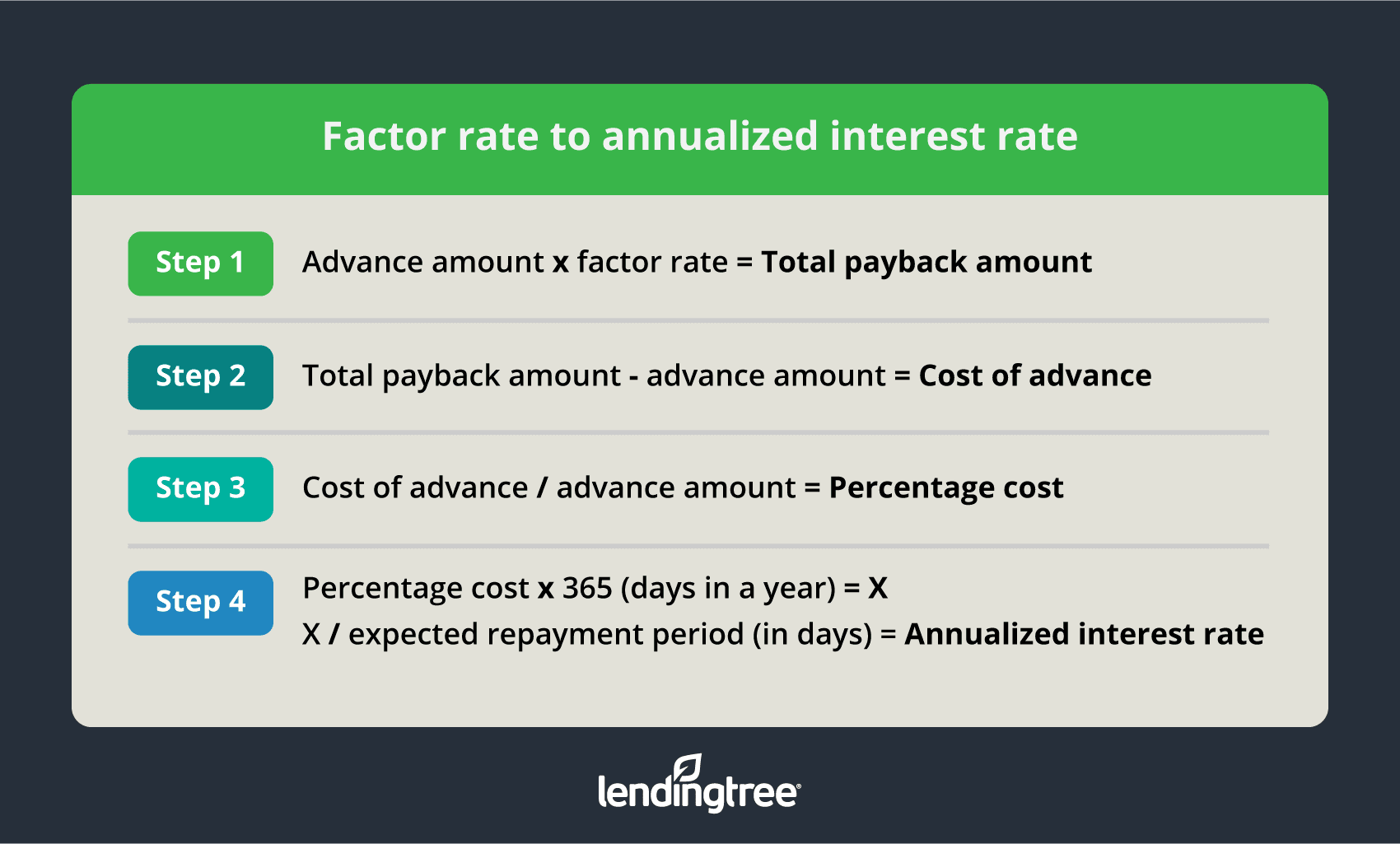

What Is A Factor Rate And How Do You Calculate It

Effective Interest Rate Formula Calculator With Excel Template

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Effective Annual Rate Formula Calculations Video Lesson Transcript Study Com

How To Calculate Interest Rate 10 Steps With Pictures Wikihow