Bus depreciation calculator

Depreciation forecasting and bus purchase simulations for school district owned buses can be made using the Excel workbook provided here. Check depreciation for other Ford vehicles We.

Depreciation Formula Calculate Depreciation Expense

Our car depreciation calculator uses the following values source.

. It provides a couple different methods of depreciation. In other words the. After two years your cars value.

This depreciation calculator is for calculating the depreciation schedule of an asset. For any bus which does not have an option to purchase the lease price for the year will be placed into the cost of transportation. 12882510644 average miles per bus 012 per mile 3.

258939 insurance cost current year201 buses 128825 per bus 2. Depreciation is the allocation of an assets cost over its estimated useful life. Chapter IV paragraph 3f 2 e states that the useful life of buildings and most other facilities concrete steel and frame construction is 40 years.

School Bus Depreciation Forecasting OSPI Student Transportation Copy this range School Bus Depreciation Forecasting OSPI Student Transportation Select FleetHistory tab School Bus. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. Also paragraph IV 3f.

Next youll divide each years digit by the sum. The simplest form of depreciation is straight-line depreciation. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

After a year your cars value decreases to 81 of the initial value. 33 MB File size. Ford Transit Depreciation Calculator Find and calculate the depreciation of your Ford Transit for any stage of your ownership.

The calculator also estimates the first year and the total vehicle depreciation. First one can choose the straight line method of. Depreciation Amount Asset Value x Annual Percentage Balance.

Select the currency from the drop-down list optional Enter the. We will even custom tailor the results based upon just a few of. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

Periodic straight line depreciation Asset cost - Salvage value Useful life. 8-years depreciation equates to 125 depreciation per year. To calculate straight-line depreciation simply.

7 6 5 4 3 2 1 28. To calculate the total fuel. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. The bonus depreciation calculator is proprietary software based on three primary components. All you need to do is.

1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. It is fairly simple to use.

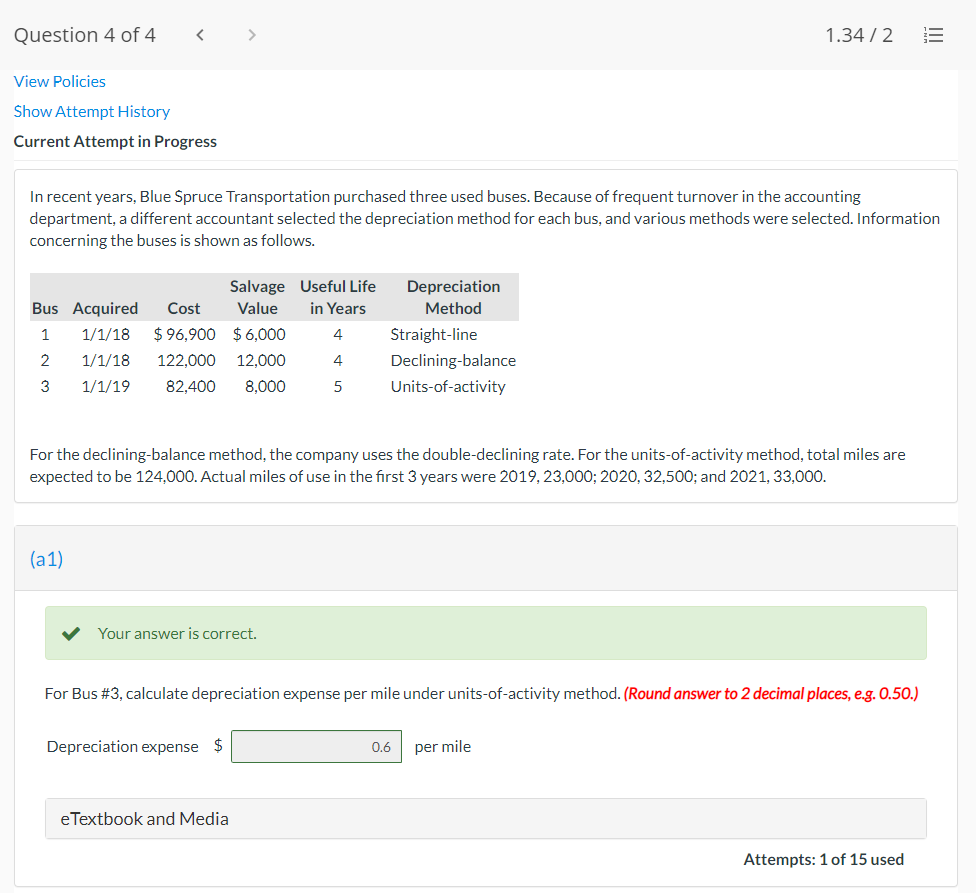

Solved Question 4 Of 4 1 3472 Iii View Policies Show Attempt Chegg Com

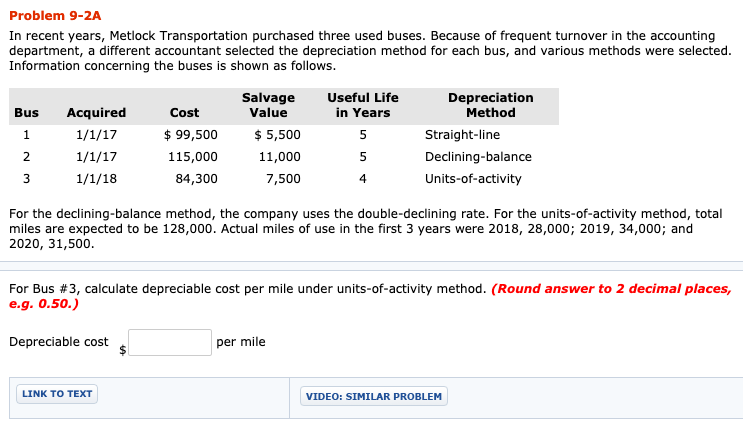

Answered Problem 9 2a In Recent Years Metlock Bartleby

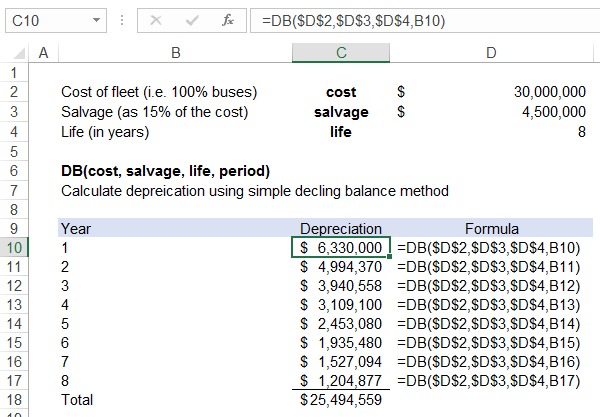

Declining Balance Depreciation Calculator

Declining Balance Depreciation In Excel Example

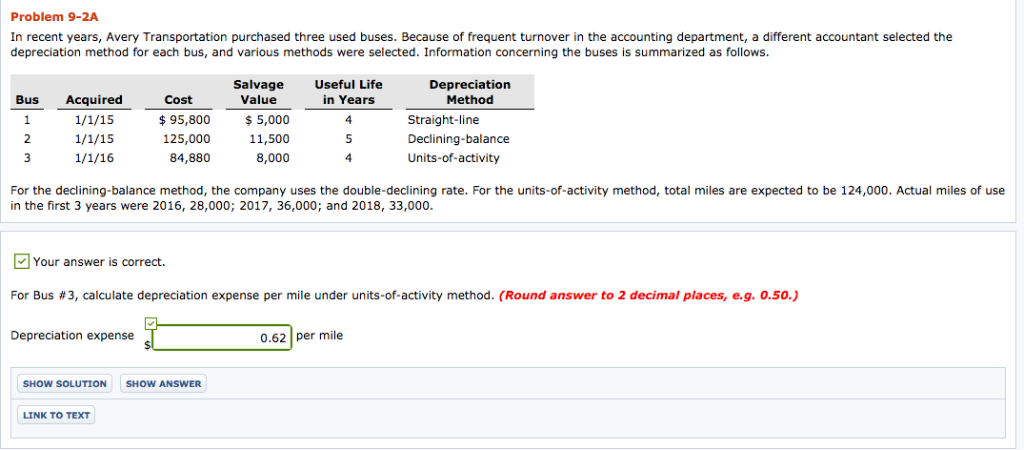

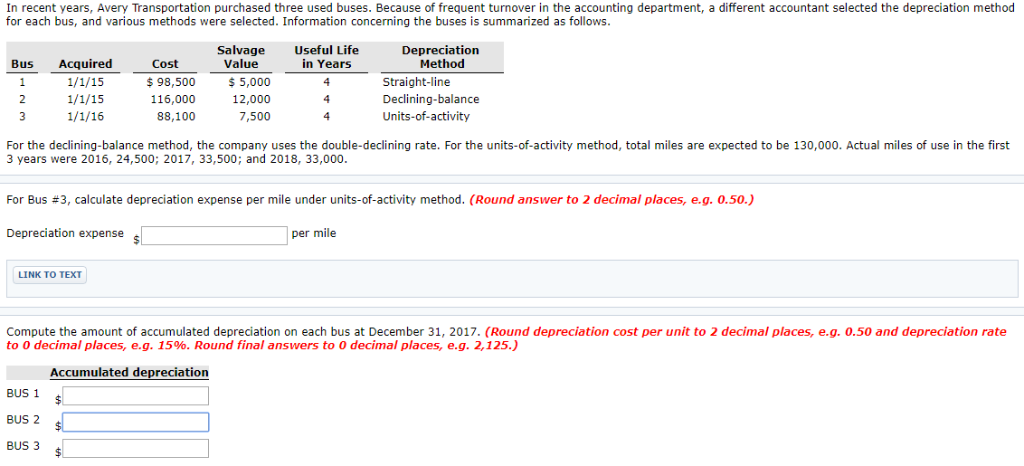

Solved Problem 9 2a In Recent Years Avery Transportation Chegg Com

Solved In Recent Years Avery Transportation Purchased Three Chegg Com

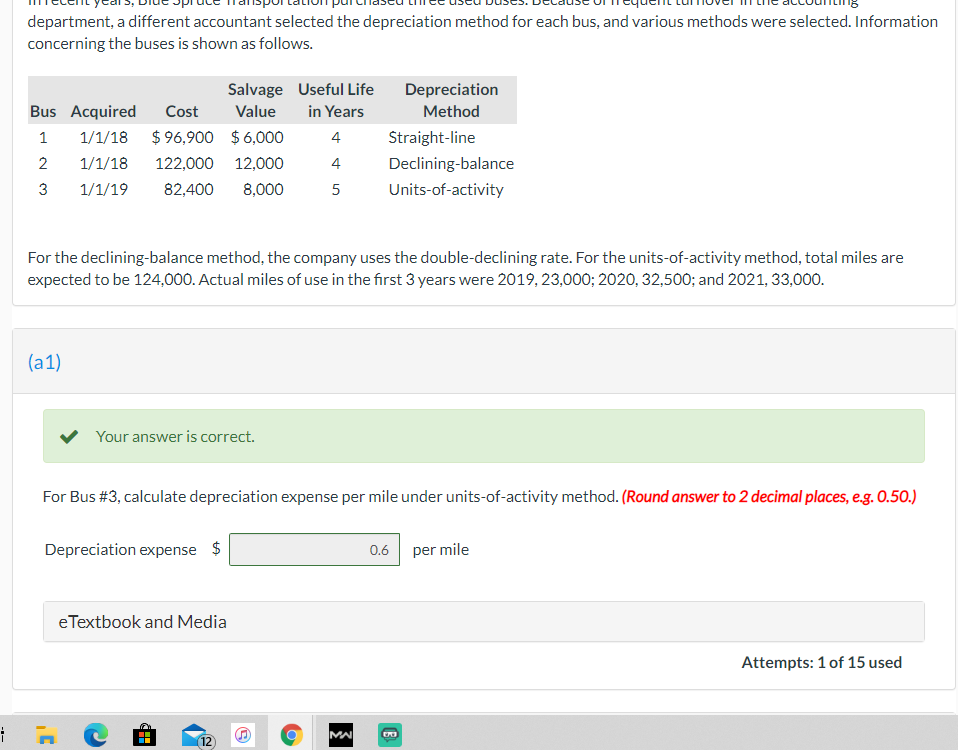

Solved Department A Different Accountant Selected The Chegg Com

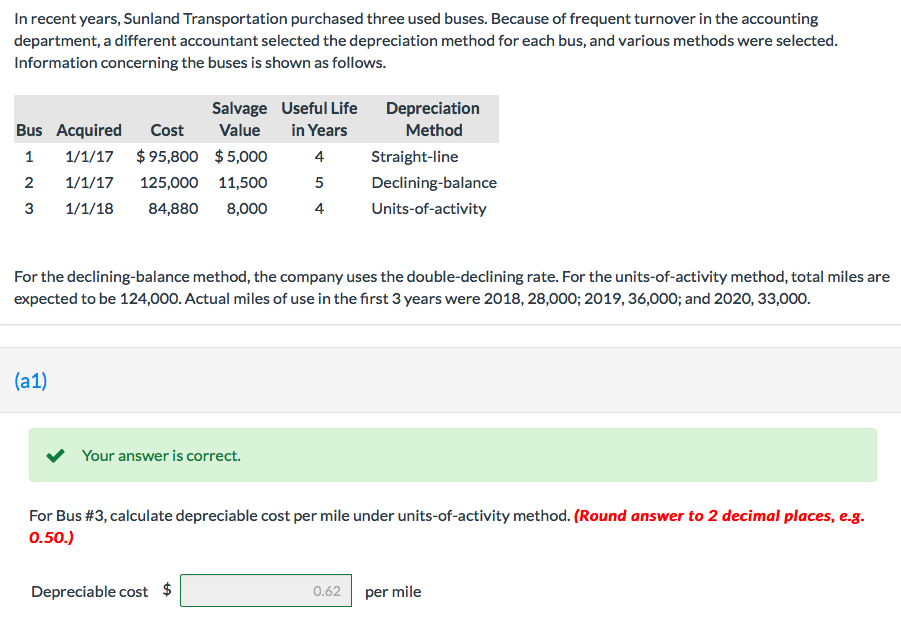

Solved N Recent Years Sunland Transportation Purchased Chegg Com

Depreciation Calculator Depreciation Of An Asset Car Property

Car Depreciation Calculator

Annual Depreciation Of A New Car Find The Future Value Youtube

Solved Problem 10 2a In Recent Years Avery Transportation Chegg Com

Macrs Depreciation Calculator Macrs Tables And How To Use

Calculating Useful Life For Depreciation Calculae Accounting Coaching

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro